Will The Economy Stall?

Since the end of the first set of the COVID-19 pandemic, consumers have been flush with cash as many received stimulus checks and/or significantly reduced their spending during the initial quarantine, due to not going out to dinner, the movies, or on vacation. This created a roaring economy starting in the summer of 2020 that saw rapid stock market growth and unprecedented consumer spending. This increase in spending meant more jobs and increased profits for companies, and many corporations were able to fulfill consumer needs.

While this was happening, there were still massive trade restrictions due to COVID, with China being almost completely out of the picture. There was a massive shortage in microchips to fuel increased technology spending, along with limitations in countless other sectors. The Institute of Electrical and Electronics Engineers hopes that an increase in American microchip manufacturers will help remedy this in the near future.

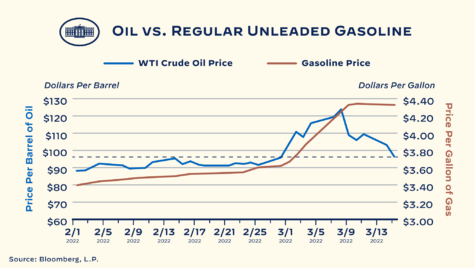

Oil and gas companies shut down gas pumps to reduce their costs due to low demand, but once the economy reopened again there was a spike in need for gas. While many tend to blame President Biden or environmental policies for high gas prices, according to the New York Times, it’s the gas companies fault for prematurely shutting down drills when there was little need for oil and gas at the beginning of the pandemic. This is why gas in the spring and summer of 2020 was so cheap. This led to a shortage of gas and the crazy prices at the pump seen last year. However, gas prices continued to rise as gallon prices of gas shot up even as crude oil prices fell. This led to record profits within the oil and gas sector, CNBC reported a collective $196.3 billion in profits amongst the big five last year-higher than any year prior.

These factors, and many more, have increased prices for companies to make and sell their products and have caused an inflation in nearly every sector of the economy. Inflation usually tracks 1 to3 years behind inflation causes which is why prices are increasing now, even as consumer spending slows.

While inflation started out naturally, with many companies having to increase prices to keep up production of products or services, much of today’s price increases are due to corporate price gouging. Many companies have, behind the guise of their own rising costs, increased prices far beyond what inflation calls for and therefore increasing inflation more.

As a result of this, global corporations are recording record level profit margins to the sharing’s of many consumers. While Americans have weathered most of these price increases, many companies are seeing drops and plateaus in sales after substantial price hikes, hinting that consumers are being squeezed too much. From household savings of over $2 trillion in early 2021 to now where, in the fourth quarter of 2022, household debt is at an all-time high of $16.9 trillion, as reported by Vox.

Consumers are no longer as resilient as they once were, causing some companies to cut back on price hikes. Kraft Heinz, a major food group, increased prices 15.2% during 2022 while inflation was only at 6.2%, an additional 9% added to their profit margin. But, in 2023, has decided to stop price increases as many consumers switch from name brand to generic to save money, according to Vox.

At the same time, however, some companies plan to continue price increases. Kellog and Procter & Gamble have seen consumers handle the price increases well with consistent sales and profit margin growth. One thing these two companies have in common is they are both necessary products: cleaning, utensils, cereal and grains.

However, if luxury sectors and goods like restaurants, clothing, airlines, and others continue their price hikes we could see a drastic stall in consumer spending. While this is, to some extent, the goal of anti-inflation policies like the Fed’s interest rate hikes, it can also be very harmful to the economy.

With reduced spending companies will freeze pay increases and resort to layoffs, as seen in the tech sector with Google terminating 12,000 employees as the economy has slowed down. This has a drastic cascading effect, as more companies lay off workers or stop giving raises then less consumers have the capital to consume, so then companies are making less, and the cycle continues.

This could ultimately lead to the economy stalling due to limited capital for those on the bottom-only enough to spend on the bare minimum. Without spending on luxury goods like dining out and clothes, which is a pattern already being seen. Reuters reported that Citigroup, Mastercard and Bank of America collectively estimated that consumer spending on luxury goods dropped 6% from September of 2021 to the same time 2022. At the same time, luxury brands are continuing to raise prices, with airfare being at an all-time high and Chanel raising prices on their standard bags $1,000 in just a year.

Consumers are being squeezed too tight, and consumers are seeing the ramifications in consumer spending numbers and current stock market trends. With corporate profit margins at an all-time high there isn’t anyone else to blame for the economy’s stagnation. In order to curb this, corporations need to slow on price hikes and set their sights on the long run, not just the next quarter.